PIASC Insurance News

Errors and omissions insurance, also known as E&O insurance and professional liability insurance, helps protect you from lawsuits claiming you made a mistake in your professional services. This insurance can help cover your court costs or settlements, which can be very costly for your business to pay on its own. What Does E&O Insurance Cover? Errors…

Errors and omissions insurance is also known as professional liability insurance and E&O insurance. This policy can help protect you from lawsuits claiming you’ve made a mistake in your professional services. This means that an errors and omissions claim filed against you can be for: Negligence Errors or omissions in your services provided Misrepresentation Violation of good…

Look, everyone can make a mistake at work. Perhaps you send an email to the wrong person, ship the wrong product to the wrong address. These common errors could disrupt business operations or lose valuable business data. If you run a retail business, a single mistake could result in a significant loss of productivity and…

Multi-factor authentication (MFA) is a security process that requires users to respond to requests to verify their identities before they can access networks or other online applications. MFA may use knowledge, possession of physical objects, or geographic or network locations to confirm identity. Why is multi-factor authentication needed? As organizations digitize operations and take on…

It’s no secret that passwords have substantial monetary value to cybercriminals. The importance of using secure, unique passwords is growing as you entrust increasing amounts of personal information to organizations and businesses that can fall victim to data breaches and password leaks. Although there may be little you can do to prevent a large-scale data…

Concern for cybercrime has increased 62% in the past year. Over 41,600 incidents and 2,013 confirmed data breaches were investigated by Verizon and its partners in the past year. The numbers paint a dark picture of the growing threat to businesses of all sizes – concern for cybercrime has increased 62 percent in the past…

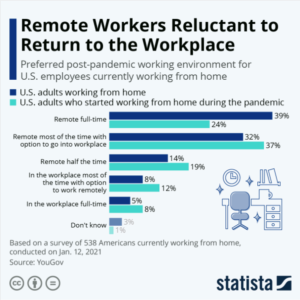

There’s a reluctance among workers to give up location flexible work after the pandemic. According to a survey conducted by YouGov earlier this year, 80 percent of Americans who started working from home during the pandemic want to continue doing so at least half the time when the pandemic is over. While 24 percent of…

As workers are encouraged to return to the office, employers are walking a tightrope fraught with liability and risk. In fact, big insurers like Chubb, AIG and Travelers are bracing for an onslaught of claims related to employment and labor lawsuits as workers head back to the office. As employers continue to grapple with the…

The last few years have seen significant changes in the commercial auto insurance market. Consequently, insurance carriers have responded by tightening their belts and increasing premiums to address years of losses. The result is a more healthy approach to address market challenges and put the brakes on the upward trend of pricing. So what can…

7 in 10 businesses aren’t prepared for cyber vulnerabilities. Large, multinational firms can absorb the financial costs associated with a cyber attack, small businesses can go bankrupt if not prepared. In today’s online world businesses need to be aware of the risks and take proactive measure to mitigate the risk. In this brief conversation you will learn what to look for and how cyber insurance can help in the event of an attack.